You are here

Taxes and Health Insurance

Download the English-version fact sheets for:

- Advance Premium Tax Credits (PDF)

- Tax Refund Primer (PDF)

For non-English versions of fact sheets and other programs, visit the Navigator program page.

Advance Premium Tax Credits

The Affordable Care Act helps make health insurance affordable for millions of people by providing assistance through the Advance Premium Tax Credit (APTC). You can only get this tax credit through the Health Insurance Marketplace. Your eligibility and the amount of your APTC depend on your household income and size.

The APTC is “advanced” because instead of waiting until you file your federal tax return to receive this credit, you can use it each month to help pay for your insurance plan. With the APTC, part of your monthly premium payment can be made by the federal government directly to the health plan in which you’ve enrolled.

If you qualify, there are three ways you can use your APTC:

- Spread the credit equally across the entire year. This means that each time you pay your monthly health insurance premium, the cost will be reduced.

- Use some, but not all, of your APTC each month. This means you'll pay more for health insurance each month and receive teh remainder of the unused APTC as a refund when you file your taxes next year. This may be a good choice if you are not sure about your income for the year.

- Not use any of your APTC during the year. If you choose this option, you will get the total amount of the APTC refunded to you when you file next year's tax return.

If you qualify for the APTC, any way you use it, you'll still get a break on the cost of your health insurance to help you get the coverage that meets your needs and budget.

Report Changes in Your Income

Life changes, like having a baby, getting married or changing jobs, can affect the amount of your tax credit or even your eligibility.

For example, if you make more money than you expected, your APTC will be lower and you might owe some money at the end of the year. But if you make less, you'll get a refund.

You can go back to the Marketplace website and report your changes when they happen. You'll get your tax credit calculations updated automatically.

Understanding Your Tax Credits

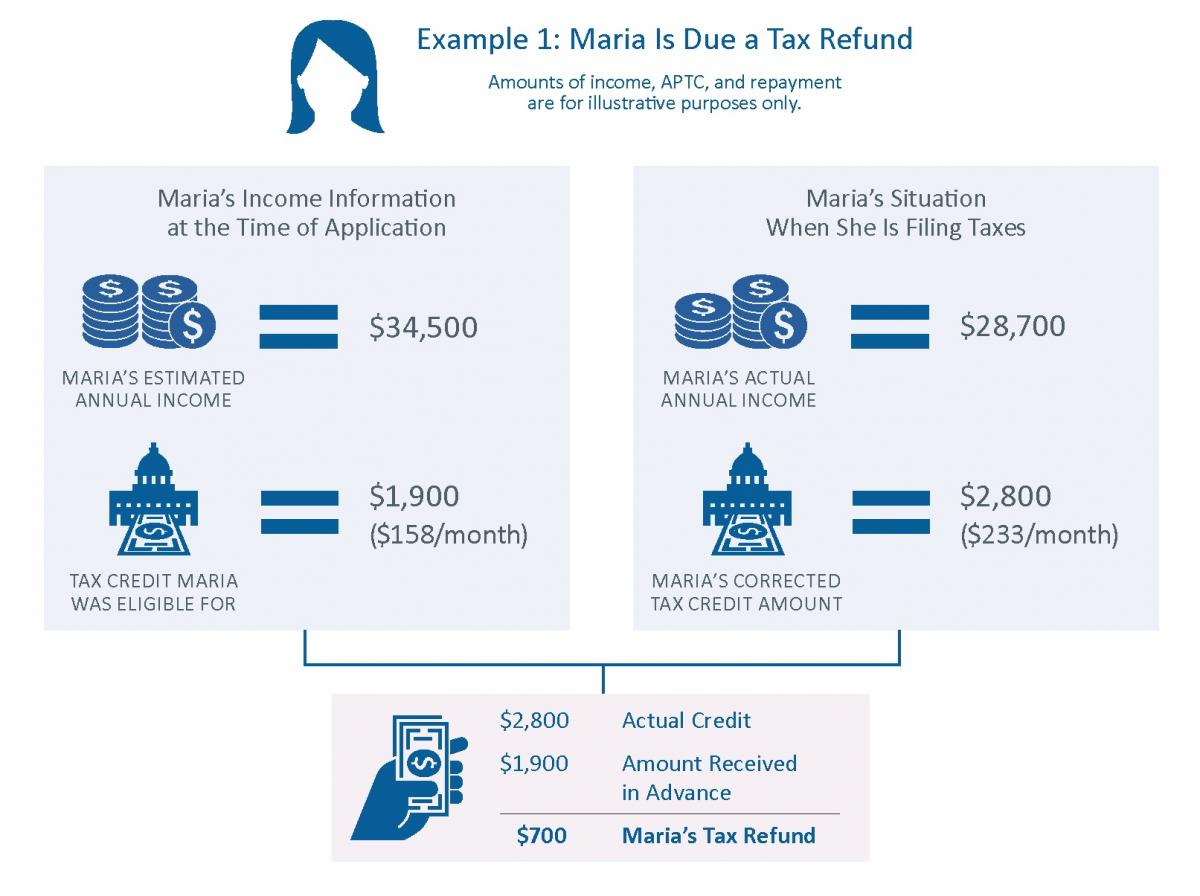

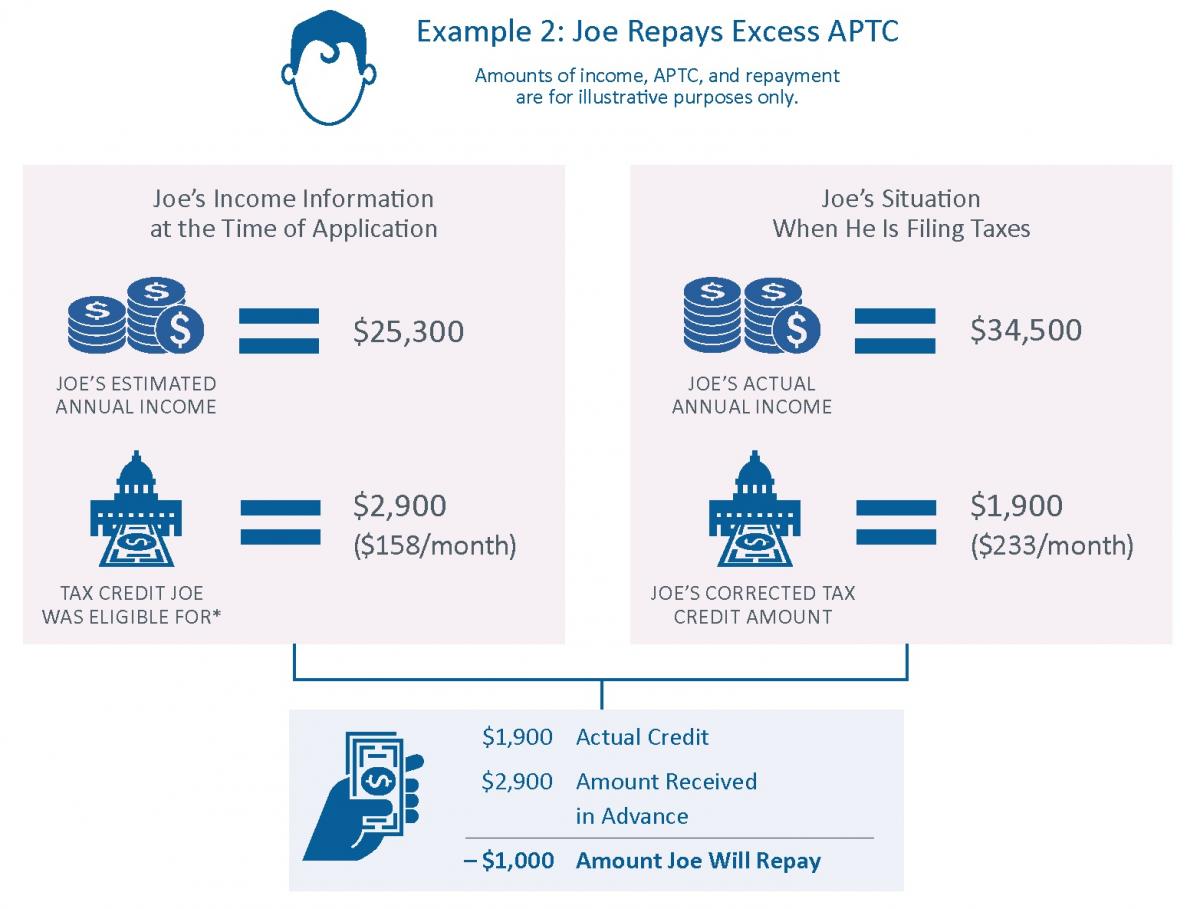

The Advance Premium Tax Credit (APTC) helps make your health insurance more affordable. The money will not be provided directly to you; instead, the federal government will use the APTC to pay a portion of the health plan you have selected. Here are two examples.

Example 1: A person ends up receiving a tax refund at the end of the year because her income decreased. Maria applied for health insurance coverage and was approved for an APTC. She decided to receive the entire APTC in advance. Then her hours were cut at work, so she didn’t earn as much money by the end of the year as she had expected to. With her income being lower, she was eligible for a larger tax credit, so she received a tax refund.

Example 2: A person ends up having to repay the government for some of the the amount of APTC he received because his income increased. Joe applied for health insurance coverage and was approved for an APTC. He decided to receive the entire APTC in advance. But part-way through the year, he found a better-paying job, so he earned more money by the end of the year than he expected. That means that Joe may have to repay the government for some of the APTC that he originally qualified for.

The content for this page was supported by Funding Opportunity Number CA-NAV-13-001 from the U.S. Department of Health and Human Services, Centers for Medicare & Medicaid Services. The contents provided are solely the responsibility of the authors and do not necessarily represent the official views of HHS or any of its agencies.

this page